Why “Buy the Dip” May Not Be the Best Advice for You

February 12, 2022 | by V. Henry Astarjian | Posted in Blog

The investing world is full of “one size fits all” advice from both seasoned and novice investors. Some pieces of advice are tried and true, while others, whether true or not, are told and retold so often that they become widely accepted truisms.

Among these is the “buy the dip” mantra that we hear so often now, mainly from less experienced investors who believe it to be a surefire recipe for investing success. Its roots are another concept, specifically “buy low, sell high”.

The grand idea behind “buy the dip” is that since the stock market moves higher over time, given an opportunity to buy a stock at a lower price now, you should always take that opportunity with the goal of selling it at a profit down the road. While that sounds reasonable, it can be fraught with dangers.

It assumes that everyone is more or less in the same age category, young enough to have many years or even decades of investing ahead of them. For investors in their 50s, 60s, 70s, or older, years of waiting for an investment to pan out may not be an option.

It assumes the stock market always bounces back in some timely fashion, allowing for quick profits. In reality, the stock market does not always bounce back quickly from a drop. If it does, the bounce may be only a prelude to another drop even lower.

It assumes that investors are able to stomach the roller coaster drops in the markets, then to have the necessary nerves of steel to buy at the lows of the dips, and then to sell at the near-term highs.

Many investors don’t have the confidence to step into the market and to buy low when prices have dropped. Buying low when everyone else is selling means bucking the trend and having the courage of one’s convictions. That’s a tall order for most people, including many investment managers.

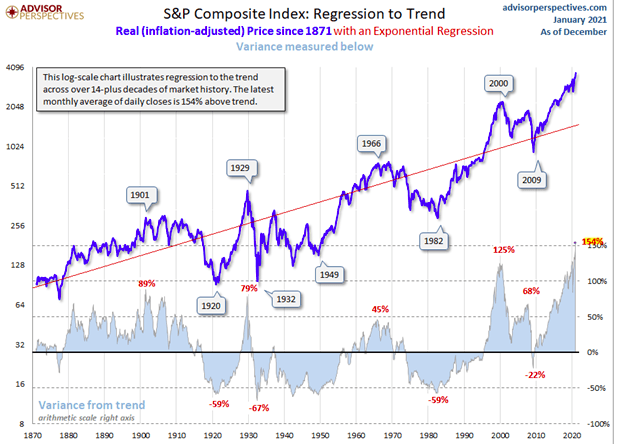

This recent chart of the inflation-adjusted S&P 500 Index illustrates the difficulties in the “buy the dip” strategy. The period from 1966 to 1982 is a good example. Over that timeframe, an investor would have had many opportunities to buy the dips in the market. Yet, profiting from that strategy would have meant selling near each of the intermediate term highs, a very difficult and tricky task, and one which most investors would have been unable to achieve. By the time all was said and done, the S&P 500 had fallen 59% over that 16 year period, and it took another several years for the market to get back to where it was during each of those previous dips.

For alternatives to the “buy the dip” strategy, please see our investment letters and blogs which focus on long-term investing approaches for conservative investors.

Disclosures: Waterstone Advisors, LLC is a Massachusetts registered investment advisor. Registration with securities authorities does not imply a certain level of skill or training. Investment results are not guaranteed. Investing carries risk of loss, including loss of principal. For additional information and disclosures, please see our ADV Part 2 (the “Firm Brochure”) in the Our Approach page of our website at www.waterstoneadvisorsllc.com , or contact us at 978-828-2188.