Why Interest Rate Increases May be Limited

April 9, 2022 | by V. Henry Astarjian | Posted in Blog

Interest rates are an important component of stock market returns. They are the cost of borrowing for businesses and consumers alike. They are the cost of debt.

Debt is the financial substance that greases the wheels of public and private commerce worldwide – without it, or with less of it, commerce tends to slow.

As with other things, when the cost of borrowing rises, as it has recently, less money is borrowed, and economic activity slows.

And with slower commercial activity, companies, consumers, and investors start to worry.

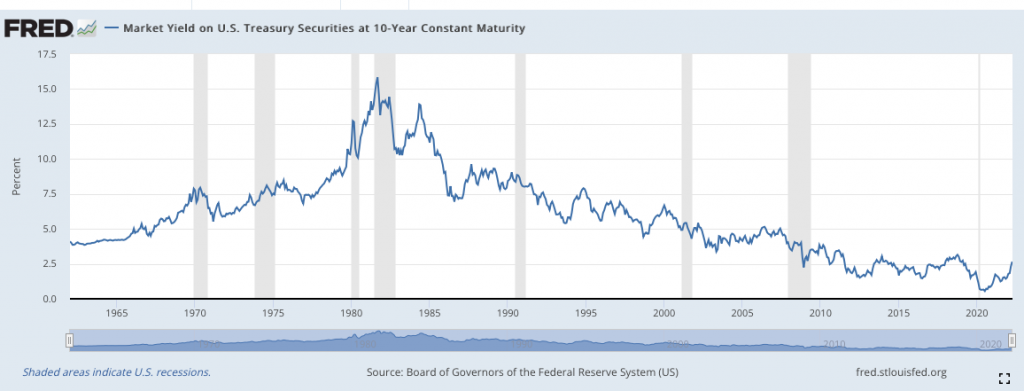

This long-term chart of the yield on the U.S. 10-Year Treasury Note shows the history of interest rates going back to 1960. The 10-Year Note is often used by lenders and businesses to set consumer interest rates, so its level and direction matter for nearly everyone who needs to borrow money.

Looking back, this interest rate peaked in 1981 at almost 16% as the Fed deliberately spiked interest rates to fight inflation that was annualizing at more than 13%. Over the next 40+ years interest rates trended down, reaching an all-time low of 0.6% in August of 2020. That marked the depth of the Covid pandemic when the economy was virtually shut down.

It was that secular downward trend of ever cheaper borrowing from 1981 onward, that in large part supported the bull markets of the next 40 years, all the way to the bull market we are experiencing now.

Where interest rates will go in the future is anyone’s guess. Inflation is the primary reason the Fed has recently raised interest rates from their near-zero levels of the past few years, signaling the possibility of future interest rate increases as well.

Yet, as with so much in the recent past, the moving economic parts that led in the first place to the inflation we have today, may ease and may negate the need for much higher rates. Perpetually higher interest rates may not be cast in stone – at least not yet.

Time will tell.

Disclosures: Waterstone Advisors, LLC is a Massachusetts registered investment advisor. Registration with securities authorities does not imply a certain level of skill or training. Investing carries risk of loss, including loss of principal. The information and data presented in this note have been compiled from publicly available sources that are believed to be reliable. However, their accuracy is not guaranteed. Waterstone Advisors LLC does not guarantee the performance of the securities or strategies discussed or analyzed in this note. An investment in these securities or strategies may result in complete loss of principal. For additional information and disclosures, please see our ADV Part 2 (the “Firm Brochure”) in the Our Approach page of our website at www.waterstoneadvisorsllc.com , or contact us at 978-828-2188.