How Gauging Investor Sentiment Can Make You a Better Investor

February 19, 2022 | by V. Henry Astarjian | Posted in Blog

We tend to think of the stock market as an impersonal machine, running automatically and anonymously almost 24/7. But in fact the stock market is real people buying and selling ownership stakes in real companies with the hope of making money.

As an organic thing, the stock market is an expression of mass psychology. It mirrors the moods of its participants, the millions of buyers and sellers who come to it every day from around the world.

For serious investors, understanding where that mood stands during any particular period can lead to better investment decisions. It can help to avoid some of the traps that result in loss.

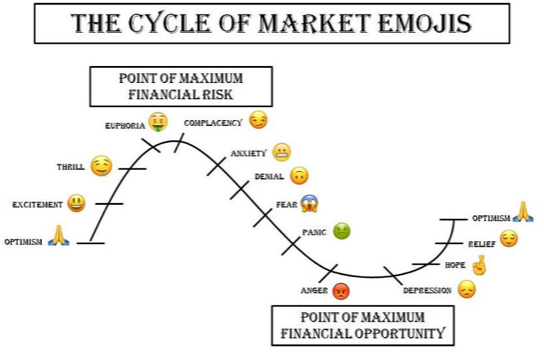

This chart from Forbes perfectly illustrates the full cycle of the moods that investors experience as the market rises and falls like waves on the ocean.

At the Euphoria and Complacency stages of the Cycle, retail investors are often less concerned about what’s going on in the economy and the corporate world, and more concerned about not missing a moving train – the rising stock market. If the train is climbing to the top of the mountain, they are definitely getting on for the panoramic views no matter how cloudy the summit may be at the moment.

At the very top of the market, where money-making seems easiest for individuals, institutional investors often start to step back, selling their shares to retail investors who often think that the market will continue to rise as it has for some time. Of course this is a circular argument, and it focuses more on the past than the future. As a result, individual investors tend to increasingly chatter about the markets and to pile into stocks at the top of market cycles.

Increasingly, online chat rooms serve as the foundation upon which retail investors build their confidence to jump into a rising market. Participants encourage each other to buy or to sell stocks based on their opinions and discussions. Predictably, this is often a case of the blind leading the blind.

No doubt, many who seek the advice of others online are genuinely confused and are looking for good investment opportunities. Others, of course, are looking for fast money, which they may or may not make by listening to people who might be just as lost as they are.

As the stock market gets stretched from all this frenzied buying, the likelihood of a correction or a bear market increases, until the market pops.

At the very bottom of the investor sentiment cycle, anger and depression take over. This is the point at which defeated investors can be heard saying things like “I held on for too long”, “I should have sold when I could”, “I’ll keep my stocks for the long term”, “At least I’m getting good dividends”, and that old bit of self delusion, “The stock market is rigged”.

If any generalization can be made as a guide to better investing, it is that retail investors as a group tend to have bad timing. They frequently buy when they should be selling, or sell when they should be buying. They are often viewed as a contrary indicator for asset prices in general, and stock prices in particular. Their enthusiastic foray into stocks last year was a foreshadowing of the weakness we have seen in the markets recently.

Gauging investor sentiment at any point in time, and knowing where it is in its cycle is a helpful way to know how to be invested and when. Buy, hold, or sell? It may have to do with the market’s moods.

Disclosures: Waterstone Advisors, LLC is a Massachusetts registered investment advisor. Registration with securities authorities does not imply a certain level of skill or training. Investment results are not guaranteed. Investing carries risk of loss, including loss of principal. For additional information and disclosures, please see our ADV Part 2 (the “Firm Brochure”) in the Our Approach page of our website at www.waterstoneadvisorsllc.com , or contact us at 978-828-2188.