Investing With the Investor Sentiment Cycle

February 24, 2023 | by V. Henry Astarjian | Posted in Blog

“I will tell you how to become rich. . .Be fearful when others are greedy. Be greedy when others are fearful.” With these insightful words, Warren Buffett neatly summed up the way investor sentiment should ideally mesh with stock market strategy to produce profits for the patient investor.

Understanding investor sentiment and its role in stock market cycles can inform our buy and sell decisions and help us to become better investors.

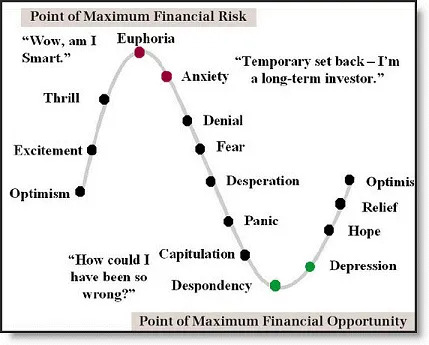

The diagram below shows that investor euphoria goes hand in hand with the stock market’s peak, while despondency marks its trough. A market where sentiment is depressed may offer good long-term buying opportunities, whereas a market where euphoria reigns, probably offers few. Between these two emotional extremes, there are shades of investor sentiment that can serve as mileposts on the stock market’s cycles.

In the recent past, December 2021 marked a peak in investor euphoria and was followed in 2022 by one of the worst years in the stock market since 1928: the S&P 500 lost more than 18% of its value for the year, while the NASDAQ Composite tumbled more than 33%. The market’s increasingly euphoric mood in 2020 and 2021 was an early warning to investors that equity returns would be challenged at some point in the future.

Conversely, in 2009, after a two year, 57% slide in the stock market from peak to trough, investors were left in a state of doom and gloom. That period marked the despondency phase of the investor sentiment cycle during recent years and was a hint that potentially better equity returns lay ahead.

Identifying where we are in the cycle is not a precise science. Like many other things in the investment world, it is partly an art. Yet, getting a good sense of the market’s sentiment doesn’t have to be as complicated as quantum physics. It can be as straightforward as following the business news flow to understand what the investment pros are saying, or speaking with friends and family to observe the prevailing atmospheric mood among non-professional investors.

For example, glowing news stories extolling the virtues of stock trading can be one important sign of euphoria, especially if they are repeated often. Another might be stories about people giving up their day jobs to trade stocks and other investments because they think trading and investing are easier and more profitable than working.

On the despondency side, one good indicator of doom and gloom is when investors vow never to invest in stocks again because the ride down in the latest bear market was so traumatic that their nerves are frayed and they can’t take it anymore. This was a common refrain at the market’s bottom in 2009. Unfortunately, at that time despondency caused many investors to sell at the bottom and to stay out of equities just as equities were entering a new multi-year uptrend.

Gauging atmospheric changes in investor sentiment can be a challenging task, but well worth the effort as an aid to better long-term investing.

Disclosures: Waterstone Advisors, LLC is a Massachusetts registered investment advisor. Registration with securities authorities does not imply a certain level of skill or training. Investing carries risk of loss, including loss of principal. The information and data presented in this note have been compiled from publicly available sources that are believed to be reliable. However, their accuracy is not guaranteed. Waterstone Advisors LLC does not guarantee the performance of the securities or strategies discussed or analyzed in this note. An investment in these securities or strategies may result in complete loss of principal. For additional information and disclosures, please see our ADV Part 2 (the “Firm Brochure”) in the Our Approach page of our website at www.waterstoneadvisorsllc.com, or contact us at 978-828-2188.