Despite Recent Declines, The 2009 Bull Market May Still Be Intact

May 7, 2022 | by V. Henry Astarjian | Posted in Blog

Investment managers are always running “what-if” scenarios on the stock market. It’s an exercise in expanding the mind and considering market possibilities other than the ones that may be most obvious at the moment.

It is in that vein that I hold out the possibility that the 2009 bull market may still be alive and well despite the market’s dramatic downside volatility of recent weeks. Those dramatic gyrations have been the source of much anxiety for investors, and for good reason.

Since hitting its all-time intraday high on January 4, 2022, the S&P 500 has fallen 15.6%, peak-to-trough. The technology heavy NASDAQ Composite has fared worse, falling 26% from its high. And the Dow Jones Industrial Average, the oldest and most blue chip of the three indicators, has declined 12.7%, although it remains slightly above its lowest levels.

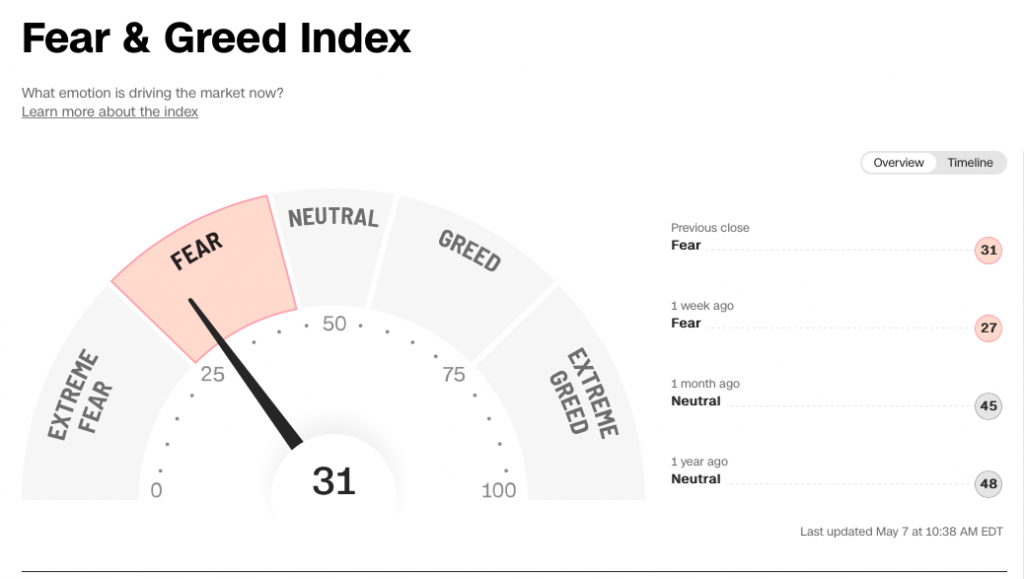

As a result, short-term investor sentiment has worsened and is now firmly in the “Fear” range, as CNN’s “Fear and Greed” index shows.

Adding to the market’s negative sentiment, the Federal Reserve Bank last week raised the country’s base interest rate by half a percentage point to 1.0% in order to aggressively deal with the highest inflation the U.S. has seen in decades. This move has served to heighten fears among many that both an economic recession and a bear market in stocks is now inevitable in the near-term.

Viewed objectively, interest rates remain low by historical standards as the chart of the Treasury’s 10-Year Yield shows (below). Rates may not yet be sufficiently high to deter business activity in any meaningful way. And while there is the normal human tendency to extrapolate events in a stright line from the present into the future, there is no assurance that rates will go ever-higher and remain elevated.

While anticipation of a recession and a bear market has considerable validity, we have no certainty on the timing of those events. Both can take time to develop, meaning that we may have many months ahead in which the bull market may continue.

Much depends on consumer demand and business activity, both of which remain broadly good. This is bullish for the stock market as it presages positive corporate sales and earnings trends down the road.

To-date, corporate earnings results have been healthy, although less robust than in more recent times. FactSet indicates that 87% of S&P 500 companies have reported Q1 2022 earnings that have exceeded Wall Street Analysts’ estimates. On the sales side, 74% of companies have reported results that have exceeded estimates. The average profit margin is 12.3% for S&P 500 companies. That is just a tad under the 5 year average 12.8%. Analysts are projecting a 10.1% rise in corporate profits for all of 2022, and a rise of 10% in sales. These are bottom-up projections taking into account each individual company’s prospects. The aggregate figures are encouraging overall.

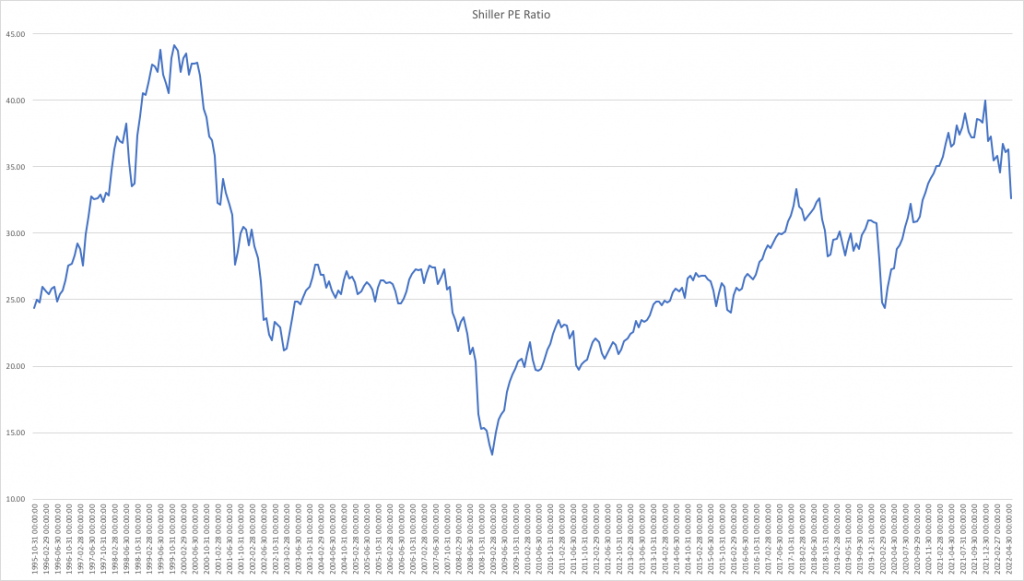

Bolstering the bull case for the stock market’s prospects, valuations have come down considerably since late last year. The Shiller P/E which measures valuations on a long-term basis, has declined from 40 in December to 32 now. While this is not a guarantee that the bull market must continue, when considered with other constructive factors, it creates a potentially positive near-term backdrop for stocks.

Disclosures: Waterstone Advisors, LLC is a Massachusetts registered investment advisor. Registration with securities authorities does not imply a certain level of skill or training. Investing carries risk of loss, including loss of principal. The information and data presented in this note have been compiled from publicly available sources that are believed to be reliable. However, their accuracy is not guaranteed. Waterstone Advisors LLC does not guarantee the performance of the securities or strategies discussed or analyzed in this note. An investment in these securities or strategies may result in complete loss of principal. For additional information and disclosures, please see our ADV Part 2 (the “Firm Brochure”) in the Our Approach page of our website at www.waterstoneadvisorsllc.com , or contact us at 978-828-2188.