Is the Bond Market Signaling a Recession Ahead?

April 2, 2022 | by V. Henry Astarjian | Posted in Blog

The war in Ukraine and the ensuing sanctions against Russia have left many investors wondering what effect the war will have on their portfolios. With world trade, interest rates, and inflation all being disrupted by the war, how will these important economic factors affect stock prices here in the U.S.?

Unfortunately, the answer may be that more restricted world trade, rising interest rates, and high levels of inflation, will tip the U.S. economy into a recession. We may already be seeing this via the Treasury bond market.

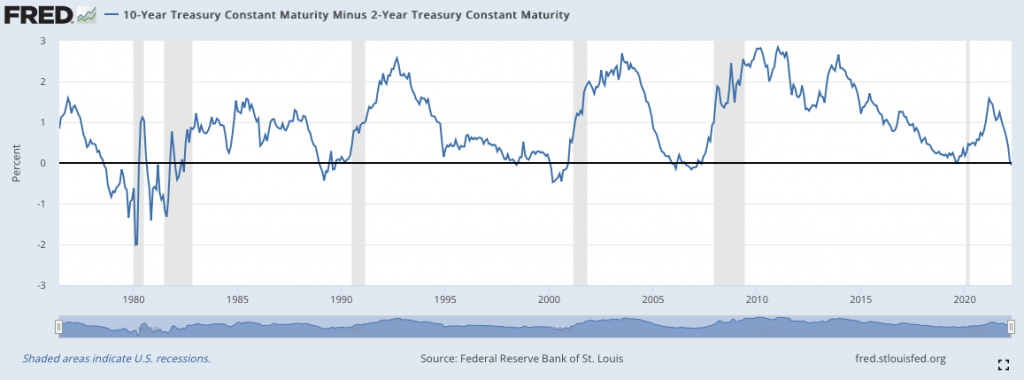

In prior periods, the Treasury yield curve has been a fairly reliable signal of future recessions, often signaling their arrival 6 to 18 months in advance. The yield curve graph at the bottom is from the Federal Reserve Bank of St. Louis. It shows the difference between the yields on the 10-Year and 2-Year Treasury Notes. The shaded bars indicate periods of recession.

The current trend of the yield curve is down, but more importantly, just this week the yield curve “inverted”. In other words, the yield on the 2-Year Note is now higher than the yield on the 10-Year Note. Normally that relationship is the opposite, with the longer maturity carrying a higher yield than the shorter maturity in order to compensate investors for unknown risks many years into the future.

An inverted yield curve is an indication that investors are uncertain about the near-term. In order to compensate for their uncertainty, they reach for the safety and income that longer-dated Treasury securities offer them for a longer period of time. In doing so, they raise the prices of those securities, causing their yields to fall. This simple relationship is not an ironclad harbinger of future economic trends, but it has proven to be fairly reliable in many cases and should be noted.

Disclosures: Waterstone Advisors, LLC is a Massachusetts registered investment advisor. Registration with securities authorities does not imply a certain level of skill or training. Investing carries risk of loss, including loss of principal. The information and data presented in this note have been compiled from publicly available sources that are believed to be reliable. However, their accuracy is not guaranteed. Waterstone Advisors LLC does not guarantee the performance of the securities or strategies discussed or analyzed in this note. An investment in these securities or strategies may result in complete loss of principal. For additional information and disclosures, please see our ADV Part 2 (the “Firm Brochure”) in the Our Approach page of our website at www.waterstoneadvisorsllc.com , or contact us at 978-828-2188.