Why You Should Care About the Inverted Yield Curve

October 30, 2020 | by V. Henry Astarjian | Posted in Blog

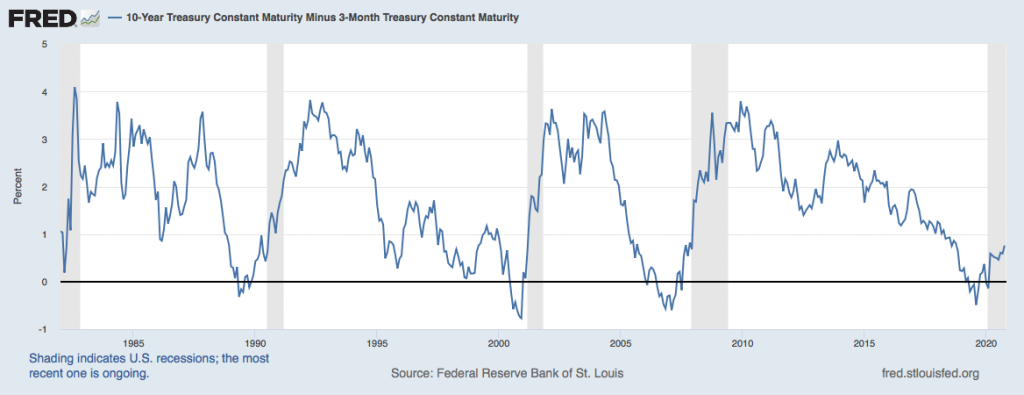

Throughout 2019, my investment letters highlighted the value of the inverted yield curve as a time-tested predictor of recessions. Whenever this relatively rare phenomenon has occurred in previous periods, a recession has ensued in as little as six months.

This chart below from the Federal Reserve Bank of St. Louis shows the inversions in the 3-Month/10-Year yield curve prior to each recession, represented by the gray bars.

An inverted yield curve is a situation in which interest rates on short-term treasury securities, such as 3-month T-Bills, are higher than interest rates on longer-term issues, such as 10-year T-Notes. This is the precise opposite of a normal yield curve and it signals that investors have little confidence in the immediate future of the economy and would instead prefer to lock in the higher rates that longer maturity bonds normally offer.

Fixed income securities such as treasuries have an inverse relationship between prices and yields. Consequently, as investors gravitate to longer-dated treasuries, such as the 10-year, the price of those securities moves higher while their yields move lower. Simultaneously, the opposite happens with short-dated treasury securities, driving their prices lower and their yields higher.

The inverted yield curve, therefore, reflects the collective sentiment of millions of domestic and international investors about the future of the U.S. economy.

And it does it in a completely unbiased way.

This is its value as a recession signal.

Disclosures: The information and data presented in this investment blog have been compiled from publicly available sources that are believed to be reliable. However, their accuracy is not guaranteed. Waterstone Advisors LLC does not guarantee the performance of the securities or strategies discussed or analyzed in this letter. An investment in these securities or strategies may result in complete loss of capital. Past performance is not a guarantee of future results. Waterstone Advisors LLC and/or its officers may have positions in the securities and /or strategies presented.